HomeSeries Fund

Residential Home(s) & ADUs

Pool capital for single homes in fix-and-flip, ADU builds, or infill/new construction deals.

Private REIT Funds

Residential Subdivisions

Hold stabilized assets or ground-up deals for solid returns. Ultimate goal is to transform raw land into generational wealth through data driven precision, local expertise & development mastery.

JV/Co‑GP Platform

Residential Subdivisions

We facilitate joint ventures between developers & investors including capital structuring & investor relations through the project. And, we specialize in match-making for developers & investors.

Land Bank

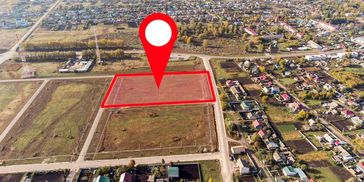

Residential Subdivisions

We partner with land‑light homebuilders through long‑term, programmatic capital relationships. Instead of tying up corp equity, builders can use us as an off‑balance‑sheet land bank.

Land banking / land finance | Development planning & finance | Project financing / A&D capital | Lot/land acquisition capital partner | Real estate capital / structured finance (homebuilding)

We are a small, entrepreneurial team that prides itself on not being out-worked, out-smarted, out-analyzed. No one works harder, or smarter, than us.

We partner with residential developers as a capital partner: We help structure the deal, bring in investor capital, and support project management and reporting from acquisition through exit.

We pool investor capital, for affiliated and select third-party projects, into a land‑bank REIT, a quantitative land fund, and select joint ventures with builders and developers. Our specific role is to raise and structure capital, control strategic land, and exit through builder options, phased takedowns, or co‑GP JVs. Our AI‑enhanced sourcing and diligence are grounded in 20+ years of market execution and $1.1B in realized asset value.

Investor experience

- Investors can expect to realize a 1.75x-2.5x+ multiple and annualized returns (IRR) in excess of 20%, preferred returns of 8%-12%, capitalizing on our AI-enhanced process and deep local market knowledge.

- Private offerings primarily for accredited investors under Regulation D exemptions; select crowdfunded opportunities may be offered where permitted.

- Regular distributions depending on the vehicle and project timing.

- Active oversight: on‑the‑ground checks, market tracking, and tight cost/time management.

DISCLAIMERS

DISCLAIMER

Targets are illustrative only and not guarantees, and past performance is not indicative of future results. Any offering is made only to eligible investors (and, for certain offerings under Rule 506(c), to accredited investors only) pursuant to a confidential private placement memorandum (PPM) and the applicable subscription documents. Neither Prodigy/Dez Capital (the “Company”) nor any of its affiliates are registered investment advisors, and neither the Company nor its representatives or affiliates provides investment advice or guarantees any investment performance, outcome, or return of capital for any investment opportunity. Investing in commercial real estate entails risk, including the risk of loss of capital up to and including total loss, and you should not invest unless you can sustain such losses. This communication is not intended to be relied upon as advice and does not take into account any investor’s investment objectives, financial situation, or needs; investors should evaluate these factors and consult a professional advisor of their choosing when determining whether an investment is appropriate. Investors are also encouraged to maintain a broadly diversified portfolio across asset classes (e.g., commercial real estate, stocks, bonds, and other investments) and should not rely on the Company as the sole, or even majority, component of their overall portfolio, but rather as one component of a diversified allocation that includes other asset classes and liquid securities not currently available through the Company.

DEFINITIONS

Non-Accredited Investor: An investor who does not meet the standard requirements to be considered an accredited investor.

Accredited Investor: A person must have an annual income exceeding $200,000, or $300,000 for joint income, for the last two years with expectation of earning the same or higher income in the current year, or have a net worth over $1 million, alone or with a spouse, excluding the value of the primary residence.

Land bank: refers to our role as a private land aggregation, investment, and entitlement platform, not a chartered bank or deposit‑taking institution.

Note on scope

No entitlement work is performed. Entitlements, if any, are pursued by counterparties or third parties.